Our investment philosophy

At Miraltabank we believe in the ability of people to change the world. Our investment experience shows us that to obtain exceptional returns you have to do things differently. To do this, it is necessary to merge talent and experience with the latest, most advanced technology.

Characteristics↓

Co-investment

We invest like you. We invest our own capital in our funds. Because the full alignment of our interests guarantees trust.

Risk management

As investors we seek to increase our risk-adjusted returns. This requires solid management of these risks.

Team

To make this possible, we have a multidisciplinary team specialized in credit, interest rates and currency. And with extensive experience in the analysis of a company’s capital structure.

Technology

In the 21st century, it is necessary to integrate technology into the investment process to evaluate millions of pieces of data and always stay one step ahead.

Co-investment

We invest like you. We invest our own capital in our funds. Because the full alignment of our interests guarantees trust.

Risk management

As investors, we seek to increase our risk-adjusted returns. This requires sound risk management.

Team

To make this possible, we have a multidisciplinary team specialized in credit, interest rates and currency. And with extensive experience in the analysis of a company’s capital structure.

Technology

In the 21st century, it is necessary to integrate technology into the investment process to evaluate millions of pieces of data and always stay one step ahead.

INVESTMENT PROCESS ↓

INVESTMENT PROCESS ↓

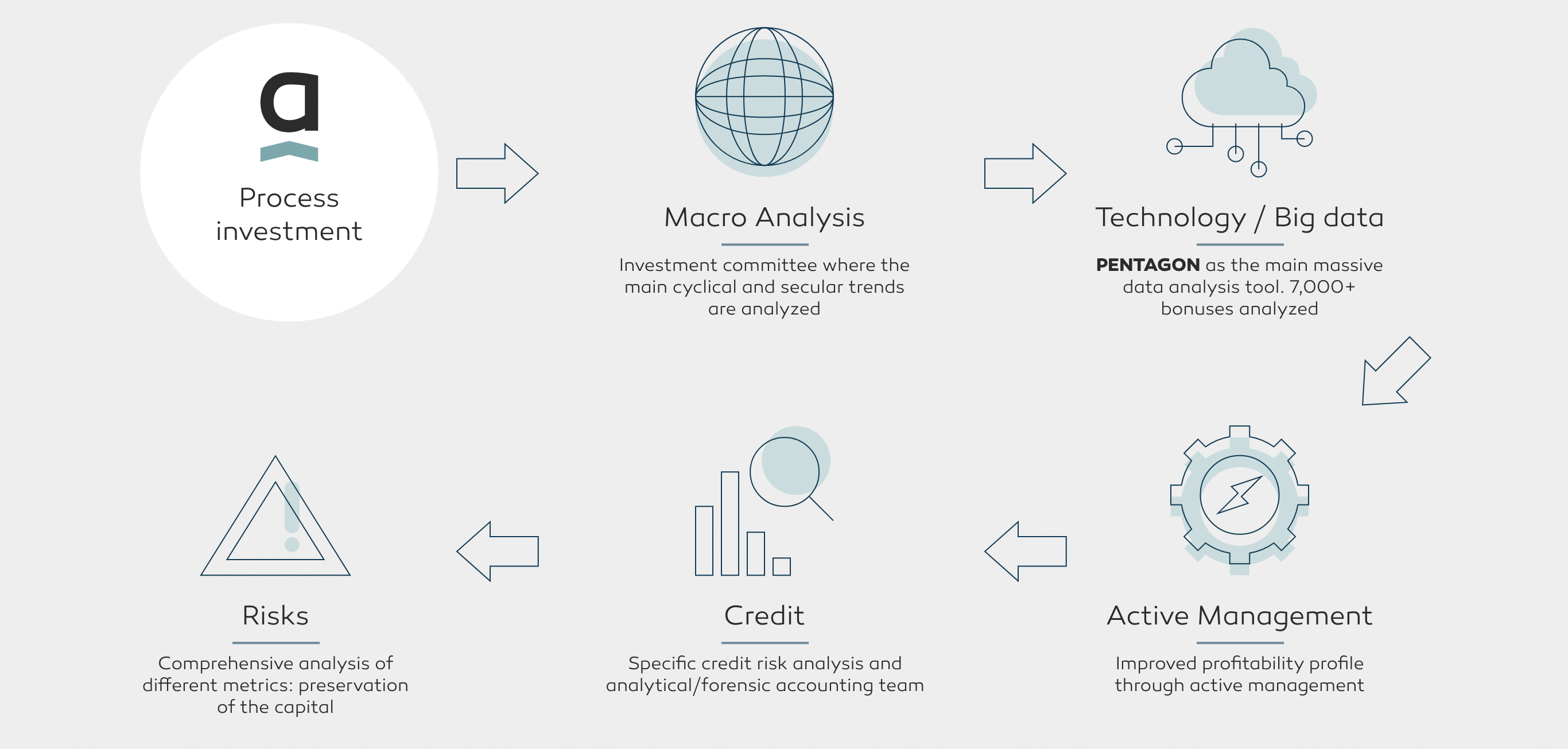

Investment Process

Macro Analysis

Investment Committee where the main cyclical and secular trends are analyzed.

Technology / Big data

PENTAGON as the main tool for massive data analysis. 7,000+ bonds analyzed

Active Management

Improving the performance profile through active management

Credit

Specific credit risk analysis and analytical/forensic accounting equipment

Risks

Exhaustive analysis of different metrics: capital preservation