Pulsar I

Returns and coupons with

greater security..

Our hedge fund (HF) is the solution to the complex fixed-income investment environment and aims to provide collateralised financing to mainly Spanish industrial SMEs to acquire strategic assets for their business development.

RENTABILIDAD ↓

6%Rentabilidad desde el origen

110,55€

Valor liquidativo* a 02-06-2021

-1,04%

Cambio del día

- En el año

- Trimestral

- 2020

- 2019

- 2018

- 24.71%

- -14.69%

- 9.5%

- -5.10%

- -5.10%

CLASS A

PERFORMANCE ↓

4.71 %Since inception

102.753883€

NAV* as at 2024-03-27

0.01 %

MTD

- YTD

- 2023

- 2022

- 2021

- 1.18%

- 0.93% + Dividend 3,56%

- 0.82% + Dividend 2,63%

- 0.49% + Dividend 0,14%

*For professional investors only

DETAILS OF THE FUND ↓

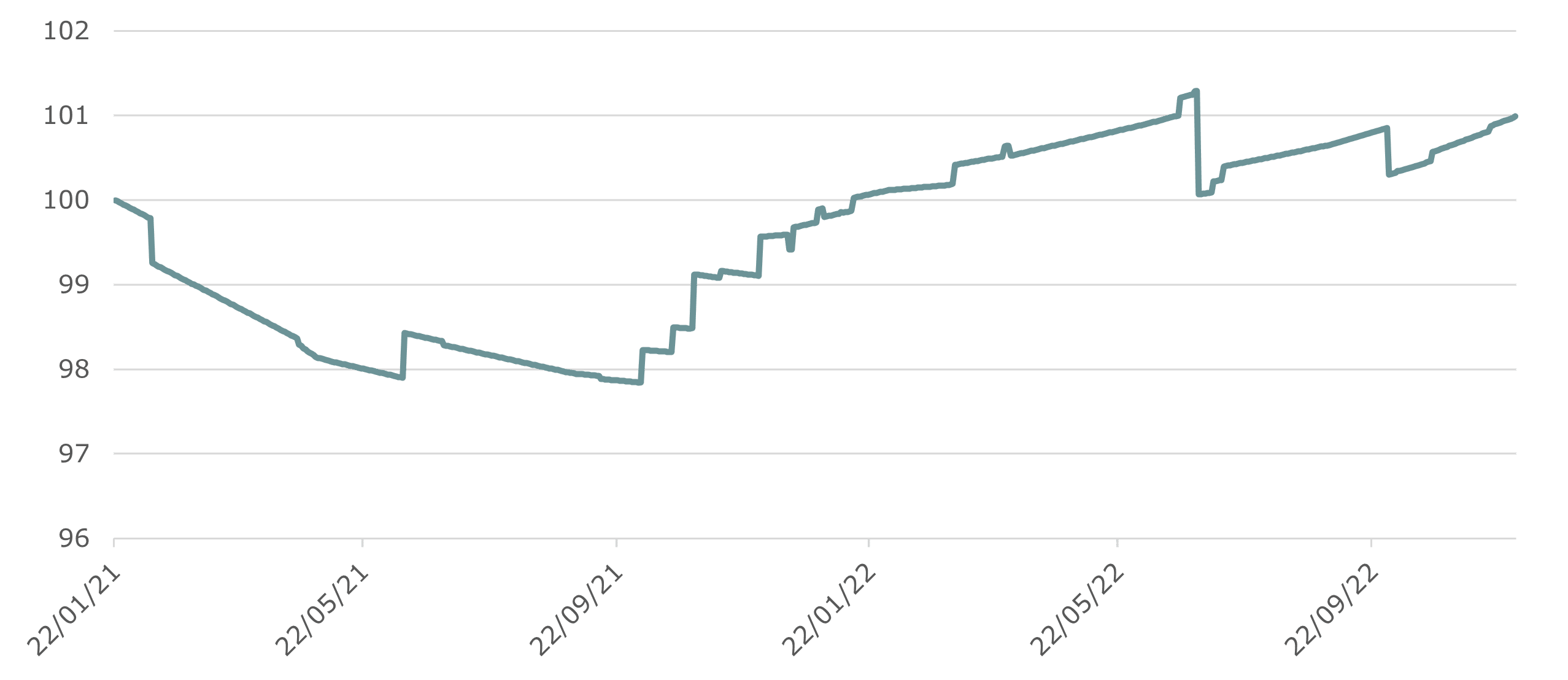

EVOLUTION OF THE NET ASSET VALUE

The net asset value includes the discount of potential quarterly coupons.

GENERAL INFORMATION

- CNMV Registration No

- ISIN Code

- Launched on

- Currency

- Management fee

- Deposit fee

- Minimum investment

- Auditor

- 90

- ES0105535001

- 22/01/2021

- EUR

- 1,20%

- 0,1%-0,075%

- 100.000 €

- Deloitte

CLASS A DETAILS

- Net asset value* as at 2024-03-27

- BASIC RETURNS

- YTD

- 1 month

- Since inception

- 102.753883€

- 1.18%

- 0.27%

- 4.71%

DATOS GENETALES

- Nº Registro CNMV

- Código ISIN

- Fecha de lanzamiento

- Divisa

- Tipos de activos

- Indice de referencia

- Comision de gestion

- Comision de deposito

- Inversion minima

- Auditor

- 5100

- ES0173367014

- 14/02/2018

- Euro

- Monetario, renta variable, gestion

- STOXX Europe 600 Net Return

- 1,10%

- 0,10% /0,075%

- 1,000,000

- Deloitte

DATOS DE LA CLASE B

- Valor liquidativo* a 19-11-2020

- Variación del valor liquidativo a 19-11-2020

- Patrimonio del fondo a 19-11-2020

- RENTABILIDADES BASICA

- 1 Día

- YTD

- 1 Mes

- Desde Inicio

- EUR106,47%

- ES0173367014

- 7.287.390,53€

- 0,71%

- 13,56%

- 12,77%

- 12,77%

(*): The net asset value and other informative documents of the funds available on this website are published in compliance with article 18.2 of the Law on Collective Investment Undertakings under the responsibility of Miralta Asset Management SGIIC, S.A.U., which is responsible for updating and maintaining them.

Data as at EOB 31/03/2024. Source: Miraltabank. The return expressed above is net of fees and expenses. Past performance is not indicative or a guarantee of future returns.

MORE INFORMATION↓

Personal information

OTROS PRODUCTOS QUE TE PUEDEN INTERESAR ↓

OTHER PRODUCTS THAT YOU MIGHT BE INTERESTED IN ↓

MiraltaBank

Pulsar II

Information

New free investment fund (FIL) designed as a strategic solution for both investors and companies.

More information

MiraltaBank

Sequoia

Information

Our fixed-income fund, based on a tacit approach to the markets. More flexibility and diversification.

More information

MiraltaBank

Narval

Information

A unique equity investment fund. Designed for the long term and specialising in quality companies.

More information

Juan Díaz-Jove del Amo

Gestor de Inversiones Renta Variable Comenzó su carrera profesional en Aviva Gestión en 2013, incorporándose más adelante a Rentamarkets como analista de inversiones. Antes de entrar a formar parte de la Gestora era el responsable de inversiones en renta variable para la cuenta propia del Grupo.

Es licenciado en Administración y Dirección de Empresas, especialidad en Finanzas, por la Universidad CEU-San Pablo, con certificación en International Business por la Universidad de Boston (BU). Empezó a estudiar y practicar la Inversión en Valor en 2011.

José María Díaz Vallejo

Gestor de Inversiones Renta Variable

Su carrera profesional empieza en 2008 en Aviva Gestión y desde entonces ha ocupado puestos de analista y de gestor en Magallanes Value Investors, Aviva y Horizon Capital. Empezó a estudiar y practicar la Inversión Valor en 2003.

Es licenciado en Derecho por la UNED y además cuenta con el Master en Mercados Bursátiles y Derivados de la UNED, es experto en Gestión de Carteras con Derivados por el Instituto BME, experto en Gestión de Carteras por el IEB y experto en Valoración de Empresas (Certifi- cación CEVE) por el Instituto Español de Analistas Financieros (IEAF).