NARVAL EUROPA

A unique fund in an ocean of investments

Every investor has their own investment objectives, but they all have the same goal of protecting their wealth and increasing their equity.

Our equity fund aims to grow its investors’ capital at a faster rate than the stock markets over the long term. We invest in leading European multinational companies to benefit from global growth and development. We seek value in great companies. Regardless of the sector in which they operate, Narval Europe invests in companies with a strong culture of innovation so that, as long-term investors, we place our capital in companies capable of creating their own future.

Benefit from long-term strategies with Miralta Narval Europe. Outperform the indices with maximum risk containment.

CLASE A

PERFORMANCE ↓

39.98 %Since inception

154.306264€

Net asset value* as at2024-04-26

0.9%

Daily valuation

- YTD

- 2023

- 2022

- 2021

- 2020

- 2019

- 2018

- 12.37%

- 19.75%

- -11.29%

- 12.70%

- 16.73%

- 8.12%

- -11.27%

DETAILS OF THE FUND ↓

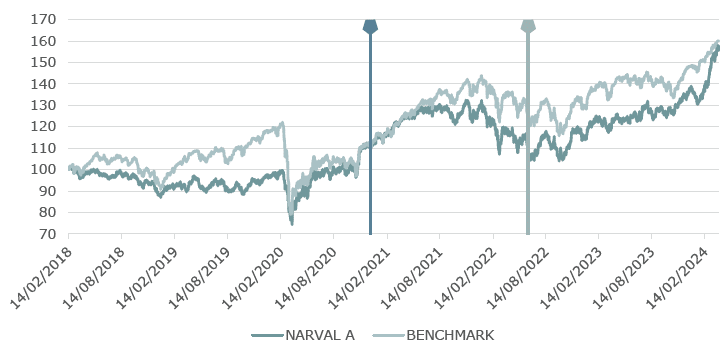

EVOLUTION OF THE NET ASSET VALUE

HISTORIC class A FUND – Data as at close of business 31/03/2024. Source: Miraltabank.

From 23/12/2022: Change in Class A management fees (1.20%/9% success) and change in benchmark index to MSCI Europe.

From 02/11/2020: Class A data valid until 23/12/22 with management fee of 1.60%, and benchmark Stoxx600 TR.

Before 02/11/2020: Class A data valid until 02/11/20 with management fee of 1.10% and Stoxx600 TR benchmark”

Managers’ comments

The stability of the yield curves, especially in the short term, during the month of March allowed the equity markets to continue the trend initiated in February. This has led the fund to gain around +9% in the month, leaving a year-to-date return of around +14%, depending on the class (+7% over the benchmark). The most profitable strategies during the month were: defense, energy, banking, gold and cryptos.

Given the high leverage that the cryptocurrency market is experiencing, and the high short-term valuations of Microstrategy and Coinbase, we have taken partial profits, and added some exposure to Galaxy Digital, which trades at much lower multiples. During the month we also added some exposure to the electricity sector through Fortum and Enagas, due to their attractive valuations. These moves have allowed us to reduce the portfolio’s beta, in anticipation of a possible correction.

GENERAL DETAILS

- CNMV Registration No

- ISIN Code

- Launched on

- Currency

- Type of assets

- Benchmark index

- Management fee

- Deposit fee

- Minimum investment

- Auditor

- 5200

- ES0173367048

- 22/11/2020

- Euro

- Monetario, renta variable, gestión

- STOXX Europe 600 Net Return

- 1,20% / 9% éxito

- 0,10% /0,075%

- 100 €

- Deloitte

CLASS A DETAILS

- Net asset value* as at 2024-04-26

- Variation of the net asset value as at 2024-04-26

- Fund assets as at 2024-04-26

- BASIC RETURNS

- 1 day

- YTD

- 1 month

- Since inception

- 154.306264€

- 0.9%

- 8,755,105.06€

- 0.9%

- 12.37%

- -1.81%

- 39.98%

Documentation

(*): The net asset value and other informative documents of the funds available on this website are published in compliance with article 18.2 of the Law on Collective Investment Undertakings under the responsibility of Miralta Asset Management SGIIC, S.A.U., which is responsible for updating and maintaining them.

Data as at EOB 31/12/2023. Source: Miraltabank. The return expressed above is net of fees and expenses. Past performance is not indicative or a guarantee of future returns.

Track record Narwhal ↓

European Large Cap Equity Fund

• Rating 5 stars in category: EV Europa Large Blend February 2023

• Rating 5 stars in category: EV Europa Large Blend January 2023

• 5-star rating in category: EV Europa Large Blend during 2022

Our pillars ↓

• Financial Method

• Sustainable Investment

• Active Management

MORE INFORMATION ↓

Personal information

OTHER PRODUCTS THAT MAY INTEREST YOU ↓

MiraltaBank

Sequoia

Information

Our fixed-income fund, based on a tacit approach to the markets. More flexibility and diversification.

More information

MiraltaBank

Pulsar I

Information

Our hedge fund (HF), a solution to the complex fixed-income investment scenario

More information

MiraltaBank

Pulsar II

Information

New free investment fund (FIL) designed as a strategic solution for both investors and companies.

More information