Sequoia

Fixed Income Mutual Fund

Strength and flexibility

to grow.

Miralta Sequoia is a fixed income sub-fund of the open-ended investment company Miralta SICAV incorporated in Luxembourg. Miralta Sequoia has a global and flexible approach, whose main objective is to maximize returns with robust risk and volatility control. We develop active strategy and risk management to take advantage of inefficiencies in the time structures of interest rate and credit curves. The investment process implemented by Miralta Asset Management SGIIC, S.A.U. employs innovative technology to enhance the cognitive capabilities of the global macro approach. The prospectus of the Miralta Sequoia sub-fund is flexible enough to cope with multiple scenarios in the fixed income universe and OECD countries, both corporate and governmental, while maintaining a flexible duration (0-10 years), which can even be negative.

Miralta Sequoia promotes sustainability through its own ESG criteria, excluding certain sectors, companies and countries whose stocks do not meet these criteria.

The information on this website for Miralta Sequoia prior to March 2024 corresponds to the Miralta Sequoia FI fund, which was absorbed by the Miralta Sequoia sub-fund of Miralta SICAV on March 5, 2024. The prospectus and key data of the various share classes of the Miralta Sequoia sub-fund are also published on this website.

CLASS A

PERFORMANCE ↓

8.7 %Since inception

108.85€

Net asset value* as at 2024-04-26

0.24 %

Daily valuation

- YTD

- 2023

- 2022

- 2021

- 2020

- 2019

- 2018

- -1.36%

- 9.33%

- -4.95%

- 0.49%

- 8.60%

- 2.48%

- - 4.89%

**Previous 05/03/2024: data prior to the merger by absorption with Miralta SICAV class A ES0173368004

DETAILS OF THE FUND ↓

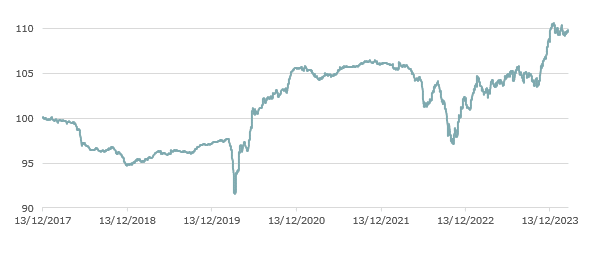

EVOLUTION OF THE NET ASSET VALUE ES0173368004

*Data correct as: 31/03/2024

Comments of the asset managers

The short-dated correction, where downside expectations have continued to dissipate, has once again negatively affected the long maturities of the curves. In this regard, the fund closed the month with a correction of around -0.50% vs. the Bloomberg Aggregate of approximately -1.25%. It is worth noting that the bad tone in growth data continues to spread to areas such as the UK and Japan, leaving the US practically alone. The high levels of real interest rates are beginning to take their toll on economic activity, and especially on the weakest companies and sectors. A few days ago we learned that at the domestic level the number of active small businesses in Spain was reaching new record lows and that the industrial sector is beginning to suffer from the restriction of working capital.

At the international level, another reflection of the effect of the high level of interest rates is the high number of defaults in Sweden during the month of January, which soared to the highest level in the last 30 years (especially in the construction and restaurant sectors). In this environment, the fund’s activity during the month has been very low, and we continue to have a large liquidity cushion in case the long maturities continue to tighten.

GENERAL INFORMATION

- ISIN Code

- Currency

- Address

- Management fee

- Deposit fee

- Minimum investment

- Class A:LU2638558333

- Class C:LU2638558507

- Class F:LU2638558416

- Euro

- Luxembourg

- 1,05% / 7% éxito

- 0,10% / 0,075%

- 100€

GENERAL INFORMATION

- Investment Manager

- Management Company

- Depositary Institution

- Managing Agent

- Auditor

- Miralta Asset Management, SGIIC

- Andbank Asset Management Lux

- Quintet Private Bank (Europe) SA

- European Fund Administration, SA

- Deloitte S.á.r.l.

Documentation

Sustainability

General

(*): The net asset value and other informative documents of the funds available on this website are published in accordance with article 18.2 of the Law on Collective Investment Institutions under the responsibility of Miralta Asset Management SGIIC, S.A.U., which is responsible for updating and maintaining the same. The sub-fund Miralta Sequoia is a performance of Miralta SICAV managed by Miralta Asset Management SGIIC,S.A.U. The manager of the Miralta SICAV is Andbank Asset Management Luxembourg..

Source: Miraltabank. The performance expressed is net of applicable fees and expenses. Past performance is not a reliable indicator of future results.

(**): Prior to 05/03/2024: data prior to the merger by absorption with Miralta SICAV class A ES0173368004

(***): © 1999 - 2024 citywire.com: Citywire. Ignacio Fuertes is AAA rated by Citywire for his rolling 3 year risk-adjusted performance, for the period monthly.

Track record Sequoia ↓

• Expansion | Best Long-Term Fixed Income fund. Awards 2023

•Morningstar | Best fund 3 and 5 years RF Diversified EUR

• VDOS | Rating 5 stars RFI GLOBAL

• Funds People Rating | 2023

• Morningstar | Top 5 2022 Diversified RF EUR

• Morningstar | Top 5 2021 Diversified RF EUR

• Morningstar | Best fund 2020 RF Diversified EUR

• Better Sharpe ratio at 3 and 5 years

Track record gestor ↓

• Citywire – Ignacio Fuertes | Best Fixed Income Manager- Euro 2022 and 2024

• Citywire – Top 2 managers of 2000 in Marz. 2023

• Citywire – Top 3 managers de 2000 in Feb. 2023

• Citywire – 24 concecutive months maximum AAA rating by Citywire

Partner. Investment Director. Member of the Investment Committe

MORE INFORMATION ↓

Personal information

OTHER PRODUCTS THAT YOU MIGHT BE INTERESTED IN ↓

OTHER PRODUCTS THAT YOU MIGHT BE INTERESTED IN ↓

MiraltaBank

Narval

Information

A unique equity investment fund. Designed for the long term and specialising in quality companies.

More Information

MiraltaBank

Pulsar I

Information

Our hedge fund (HF), a solution to the complex fixed-income investment scenario.

More Information

MiraltaBank

Pulsar II

Information

New free investment fund (FIL) designed as a strategic solution for both investors and companies.

More Information

Ignacio Fuertes Aguirre

Ingeniero de formación

Ignacio has 20 years of experience in capital markets and trading. Ignacio started his career at Merrill Lynch in London.

Later, he joined Vega Asset Management as head of execution and trader of the Vega Global fund. Prior to founding Rentamarkets (now Miraltabank), he was a manager at the alternative fund manager Próxima Alfa.